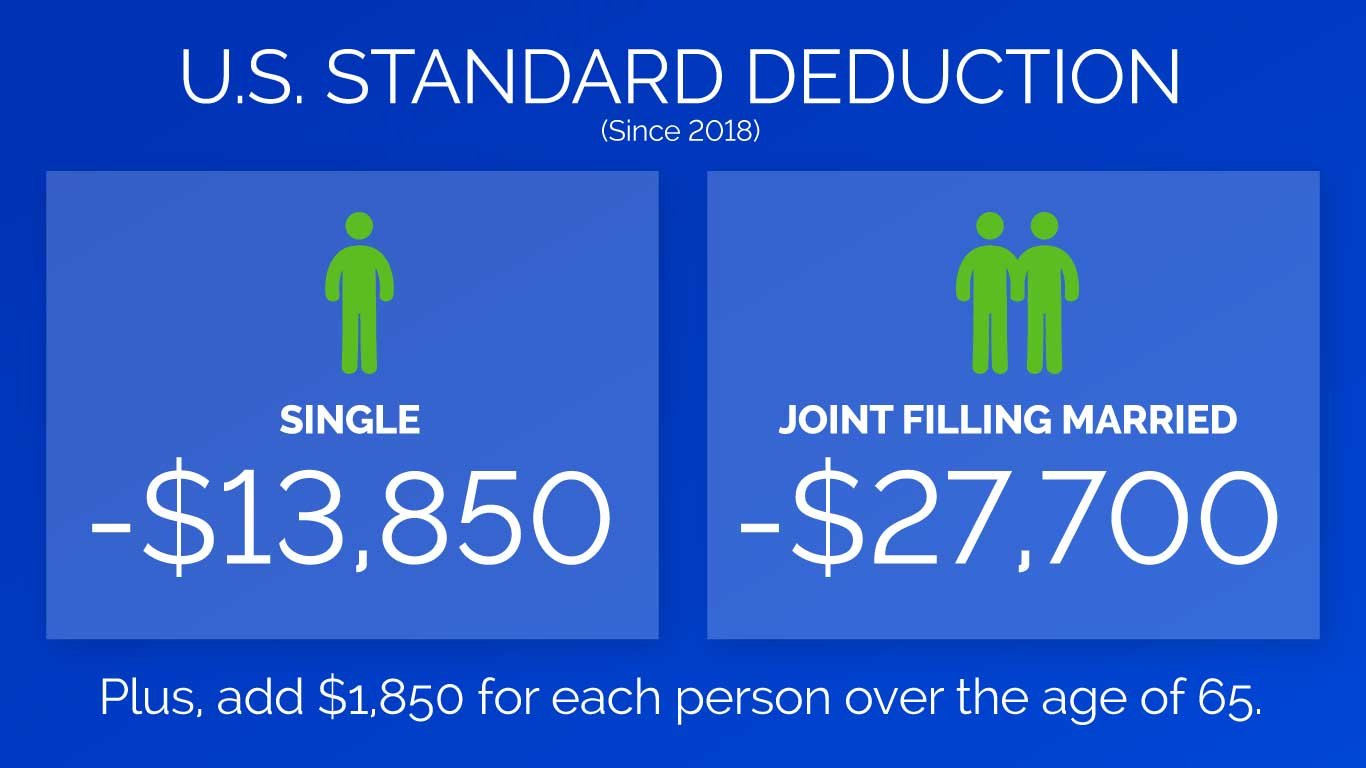

Irs 2025 Standard Deduction Over 65 Married Finest Magnificent. Increase from $14,600 (2024) to $15,000 in 2025. Increase from $29,200 (2024) to $30,000 in 2025.

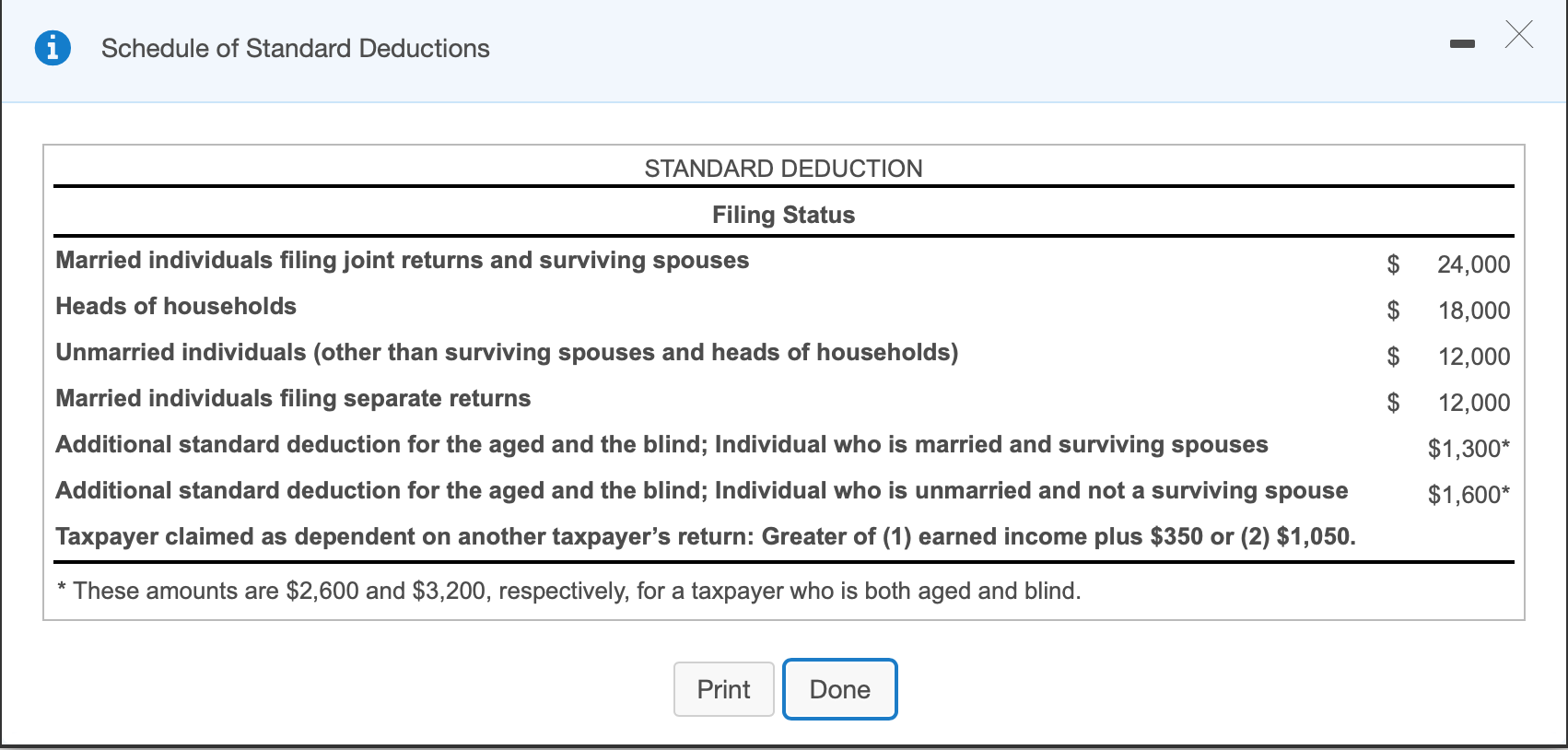

For 2025, the additional standard deduction amount for the aged or the blind is $1,600. For 2025, the standard deduction rises by $400 to $15,000 for single filers, $800 to $30,000 for married couples filing jointly, and $600 to $22,500 for heads of household. For example, if you are married and both you and your spouse are over 65, your total standard deduction for 2025 would be $33,100 ($30,000 + $3,100).

Irs Standard Deduction 2025 Married Over 65 Jaxon S. Dinah Increase from $21,900 (2024) to $22,500 in 2025. For 2025, the additional standard deduction amount for the aged or the blind is $1,600.

Source: deeannasebertina.pages.dev

Source: deeannasebertina.pages.dev

Standard Deduction 2025 Married Jointly 65 Carey Maurita Each qualifying spouse will see an increase to $1,600. For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises.

Source: gingervemmalynn.pages.dev

Source: gingervemmalynn.pages.dev

Standard Deduction 2025 Over 65 Married Lonna Joelle Increase from $21,900 (2024) to $22,500 in 2025. Increase from $29,200 (2024) to $30,000 in 2025.

Source: emiliwillis.pages.dev

Source: emiliwillis.pages.dev

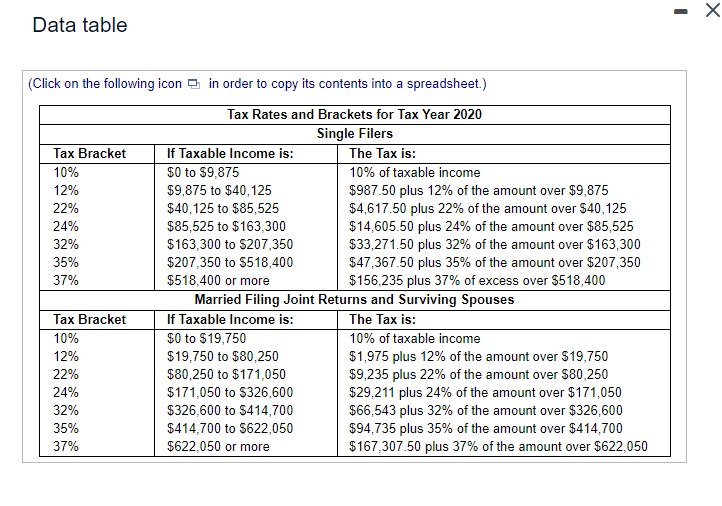

Standard Tax Deduction 2025 Married Over 65 Emilia Willis Your bracket depends on your taxable income. For 2025, the additional standard deduction amount for the aged or the blind is $1,600.

Source: leonaasetabitha.pages.dev

Source: leonaasetabitha.pages.dev

Standard Deduction 2025 Married Jointly 65 Carey Maurita For example, if you are married and both you and your spouse are over 65, your total standard deduction for 2025 would be $33,100 ($30,000 + $3,100). For 2025, the additional standard deduction amount for the aged or the blind is $1,600.

Source: frankcneely.pages.dev

Source: frankcneely.pages.dev

Standard Deductions For Married Couples Over 65 In 2025 Frank C. Neely There are seven federal tax brackets for the 2025 tax year: For 2025, the additional standard deduction amount for the aged or the blind is $1,600.

Source: frankcneely.pages.dev

Source: frankcneely.pages.dev

Standard Deductions For Married Couples Over 65 In 2025 Frank C. Neely For example, if you are married and both you and your spouse are over 65, your total standard deduction for 2025 would be $33,100 ($30,000 + $3,100). For couples where both are 65 or older, this.

Source: chelseaclewsl.pages.dev

Source: chelseaclewsl.pages.dev

2025 Standard Deduction Married Joint Senior Chelsea L. Clews Your bracket depends on your taxable income. For 2025, the irs has adjusted the standard deduction amounts for all taxpayers to account for inflation:

Source: jaxondinahs.pages.dev

Source: jaxondinahs.pages.dev

Irs Standard Deduction 2025 Married Over 65 Jaxon S. Dinah 10%, 12%, 22%, 24%, 32%, 35% and 37%. Increase from $21,900 (2024) to $22,500 in 2025.

Source: zahratatum.pages.dev

Source: zahratatum.pages.dev

Standard Tax Deduction 2025 Married Over 65 Zahra Tatum Each qualifying spouse will see an increase to $1,600. For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises.

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

What Are The Tax Brackets For 2025 Uk Over 65 Finn O. Greville Your bracket depends on your taxable income. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Standard Deduction Married Joint Over 65 Jeni Robbyn For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises. For example, if you are married and both you and your spouse are over 65, your total standard deduction for 2025 would be $33,100 ($30,000 + $3,100).